Oil Through the Roof

Good morning,

Today, the markets are closed for the Juneteenth holiday. In spite of a short trading week, there is one key event and some economic data that we'll want to stay abreast of this week. Fed Chair Jerome Powell is set to testify before Congress on Wednesday and Thursday as part of his semiannual testimony on monetary policy. We'll also get an update on the U.S. housing market, including new and existing home sales.

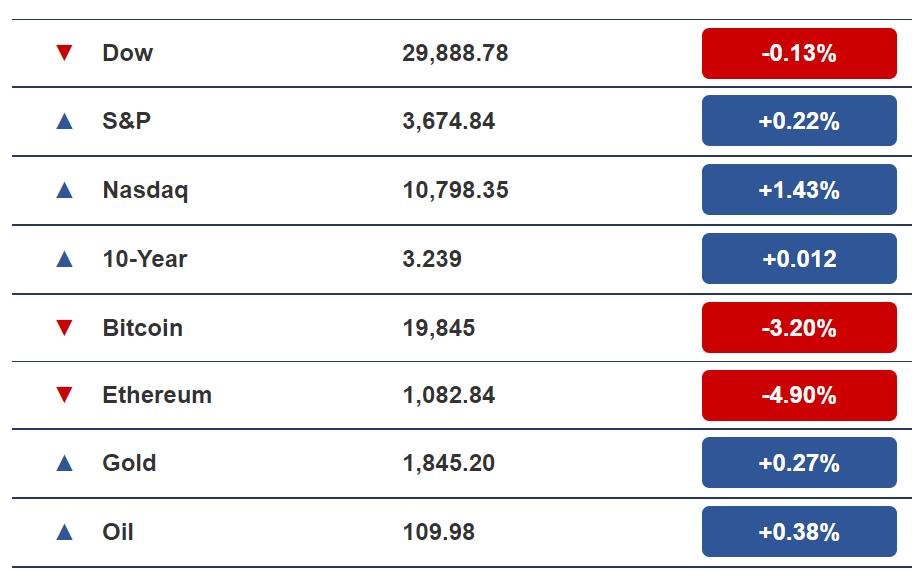

MARKET SNAPSHOT

*Stock prices as of yesterday’s market close. Crypto prices as of yesterday at 6 PM ET.

Anyway, here's what other wealth and health news is on our radar today:

- Why workout outside

- How low the market could go

HEALTH

3 Reasons to Workout More Outside This Summer

Summer solstice is nearly upon us.

Which means that with daylight hours nearing their longest point in the year, we have less excuses than before to do that workout outside— before or after work.

There are many good reasons to workout outside.

Outdoor Challenges

In the gym, workouts are predictable and the body can quickly become immune to repetitive sequences. The temperature is also closely regulated.

Working out outdoors, by contrast, places us in a less controlled environment than a gym. Our body is forced to adapt to changing temperatures, and changes in outdoor terrain can increase complexity of our workouts. Inclines, bumps, holes, and obstacles are all things that can make our workouts more difficult.

Boosted Mental Health

We all know that exercising allows the body to release feel-good chemicals called endorphins. They lead to happiness and decrease depression and anxiety.

But exercising outside only increases these feelings. Getting direct exposure to sunlight heightens our levels of serotonin, a natural mood stabilizer. It also increases vitamin D, another mood enhancer.

Stress Relief

Spending time outside, even just for a walk, can help our nervous systems manage stress more easily. Japanese studies on forest bathing, known as Shinrin-yoku, have shown that spending time outside reduces levels of cortisol, a chemical found in the body that causes stress.

MARKETS

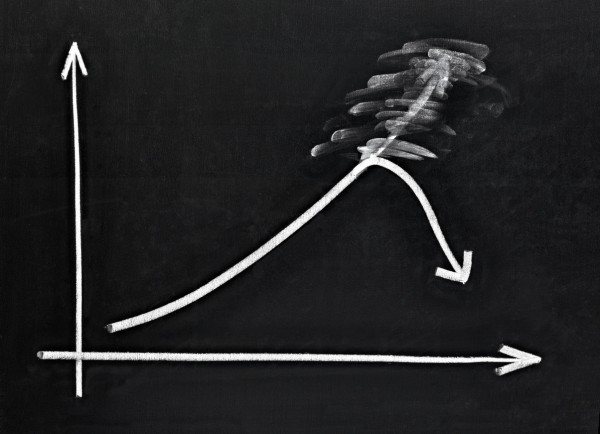

S&P 500 Down Over 20%. How Much Further It Could Fall

The S&P 500 is now officially in a bear market, having fallen over 20% since previous highs. While there is the possibility that the market could bottom soon, things could also get worse.

Stocks usually bottom out three quarters of the way through a recession. Given that no recession has been officially declared yet, that could mean that stocks have quite a bit further to fall.

Will a Recession Take Place?

Over 80% of Americans expect a recession to take place starting this year.

It should come as no surprise. Rising consumer prices remain a challenge for the central bankers, who recently raised interest rates on a 75 point basis. Even despite aggressive Fed action, it could take take as long as two years to bring inflation back down to 2%.

"Inflation is unacceptably high," Treasury secretary Janet Yellen said. But she also thinks there's a possibility the Fed could stave off a recession. She believes that the central bank may be able to bring inflation down while keeping the labor market strong.

Signs that a Recession Has Hit

Recessions are usually defined as two consecutive quarters of negative economic growth. They are usually characterized low or negative GDP growth, high unemployment, declining income, and lower retail sales.

The market can also provide clues. In a note to clients, Deutsche Bank strategists said they would expect the S&P 500 to have fallen 35% to 40% by the time a recession hits. Which is exactly why some traders are saying, "it's too late to sell, but too early to buy."

So how can you invest in the market, or avoid major losses, when it has already entered bear territory?

How to Invest During Bear Markets

Here are a few ideas...

- Take the long-term view: The S&P 500 on average returns nearly 15% per year. The losses taken during bear markets always look small in comparison to the large cumulative gains made from holding over the long term.

- Avoid timing the market: Trying to time the perfect entry into the market by calling bottom is impossible. Instead, focus on dollar cost averaging, in which investments are made at regular amounts and intervals over a long period of time.

- Buy fundamentals: Stocks with strong fundamentals are most likely to perform well in the current market environment. Look for value stocks as well as stocks with strong cash flow.