Oil Through the Roof

Good morning,

The S&P 500 just dipped into bear market territory, defined by a 20% or more fall. The reason? Inflation is relentless. It climbed to 8.6% year-over-year in the last reading. Investors continue to digest high inflation and the action that the Fed is taking to combat it. The Fed will likely take steps to raise interest rates by three quarters of a point at its next meeting. And with that in mind, a market bottom could still be a ways off. In the 13 bear markets since 1946, the S&P 500 fell by an average of 32.7%— including a 57% decline during the 2007-2009 financial crisis.

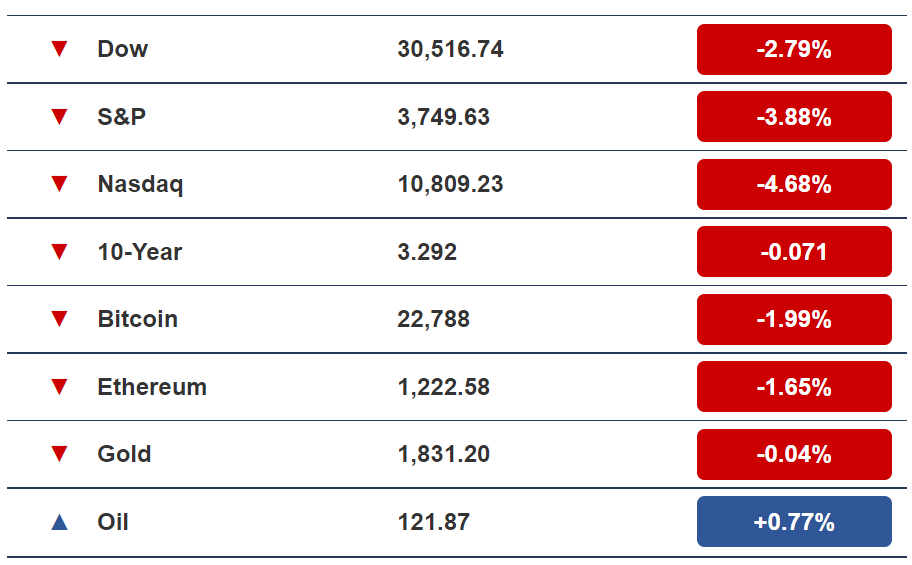

MARKET SNAPSHOT

*Stock prices as of yesterday’s market close. Crypto prices as of yesterday at 6 PM ET.

Anyway, here's what other wealth and health news is on our radar today:

- Best stretching technique

- 3 Reasons for soaring oil prices

HEALTH

New Research Reveals Proper Approach to Stretching

Stretching is an indispensable and overlooked aspect of health routines.

Stretching is necessary to ensure mobility of the muscles and joints, and it can improve posture and reduce lower back pain.

Stretching is also essential to protecting muscles from injury. If we sit in a chair all day and then use our muscles in order to play a sport, we can damage them by calling upon them too suddenly and overstretching them.

What to avoid: Doing a few quick hamstring stretches before a workout is not enough. In fact, stretching before we are warmed up can lead to injury. Real and lasting improvements in our flexibility requires that we set aside some time three to four times per week for a stretching program.

The Proper Technique

Resistance flexibility and strength training (RFST) incorporates some of the newest research on stretching.

According to RFST, the key to stretching properly is to contact the muscles while lengthening them. That means that we must actively resist while stretching.

The benefit of this style of stretching is that we can see more immediate, cumulative, and permanent gains in flexibility. We can also stretch with less pain and prevent injury while stretching.

MARKETS

Gas Prices Continue to Rise Propelling Bull Market In Oil

Rising oil prices are burning a hole in the American pocketbook.

U.S. gas prices just hit $5 for the first time ever and $5.50 is not an unlikely scenario over the coming weeks.

Why? A few reasons...

1. Russian War in Ukraine

It should be obvious by now that the Russian war in Ukraine is the primary catalyst. Cutting off oil supply from Russian, the third largest oil producer, has sent demand through the roof.

Russian oil sales have decreased, albeit slightly, but are poised to drop further when Europe phases in an embargo and decreases Russian oil reliance by a whopping 90%. That could put further pressure on gas prices, as worldwide oil supply likely declines.

2. China's Return from Lockdown

Chin's extreme measures to prevent the spread of Covid have kept the country in lockdown far longer than other nations around the world. Less economic activity, including reduced transportation and travel, has reduced its oil dependence.

However, as economic activity resurfaces, it will increase worldwide demand and competition for oil. That will raise oil prices.

3. Diminished National Oil Reserves

When President Biden first introduced sanctions against Russia, he unlocked huge national oil reserve to compensate for decreased supply. As a result, that supply is now dwindling.

U.S. oil reserves have dropped by as much as 40% following a recent sale of 180 million barrels of oil, which brought reserves to a level not seen since 1984. The country's Strategic Petroleum Reserve now has just 420 million barrels of crude oil in reserve.

How to Gain Exposure to Oil Now

Buying oil can be used as a strategy to hedge against inflation, given that the price of price of commodities can rise along with the prices of goods and services in a high inflation environment.

Investors can gain exposure to oil in a few different ways. That includes the purchase of futures or options contracts or the purchase of commodities-based ETF or mutual funds. It also include buying stocks of oil producers.

Right now, the Energy Select Sector SPDR Fund (XLE) is breaking out towards all-time highs last set in 2014.