Clues from Past Recessions

Good morning,

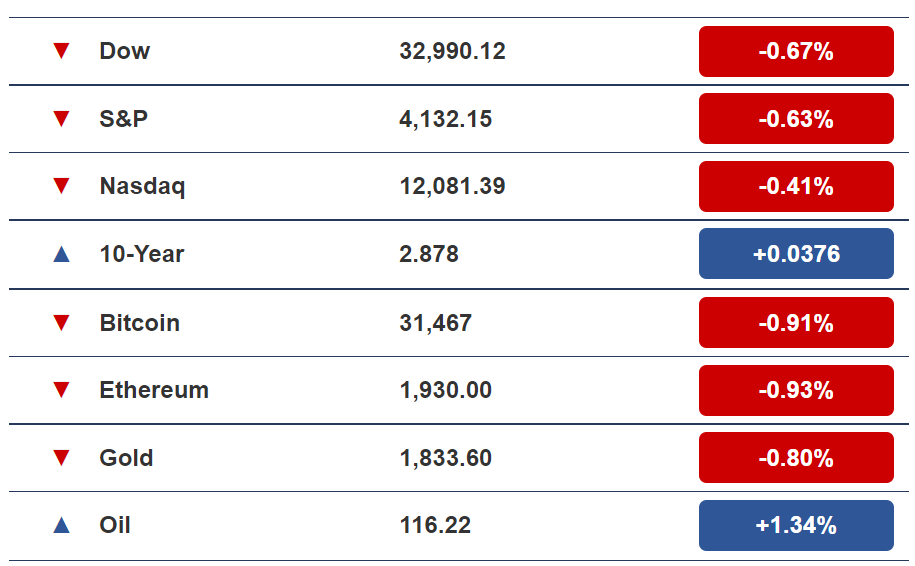

Last week's market rally has lost steam. The S&P 500 failed to break past a previous support level that is now a resistance level. Investors are continuing to digest warnings from companies like Snap (in online advertisement) and Target (in retail) about the potential impacts of inflation. While recent economic data has shown that consumer spending is still strong, Americans are digging into their savings.

MARKET SNAPSHOT

*Stock prices as of yesterday’s market close. Crypto prices as of yesterday at 6 PM ET.

Anyway, here's what other wealth and health news is on our radar today:

- Building muscle outside the gym

- 8 previous recessions explained

HEALTH

How to Build Muscle Outside of Workouts

There can be no doubt that building lean muscle is good for our health.

Lean muscle actually helps the body spend more calories and burn up fat. It is also essential to protecting our bones, which becomes increasingly important as we age.

Although strength training is essential to building lean muscle mass, there are a few things we can do outside of our workouts to help grow our muscles:

- Increase protein intake: Muscle depend on protein, especially after workouts. Protein assists in the repair process so that muscles can grow back stronger. It also helps preserve muscle mass that we've already built. Bone broth and bone broth proteins are one high-quality supplement to consider.

- Eat more: This may be controversial, especially if you're trying to lose weight. But when it comes to weight loss, oftentimes quality matters more than quantity. In order to grow and maintain muscle, we need to ensure that we have adequate intake of whole foods. Food is also essential for energy, which is much needed for our workouts.

- Rest: Overtraining can inhibit muscle growth, which is why it is essential that we 48 hours of rest in between strength training workouts. Getting more sleep is one way to help the muscles recover more quickly.

MARKETS

Historical Recessions Provide Clues to Next Recession

In the 1905 book, The Life of Reason, George Santayana famously wrote, "Those who cannot remember the past are condemned to repeat it."

While the future never turns out to look exactly like the past, we can learn a lot and avoid a whole lot of mistakes by studying events that took place in history.

That includes lessons on how to grow and protect our wealth during tough economic times.

Now that so many people are starting to use the dreaded R-word these days, it can be helpful to take a trip down memory lane and reflect on what took place during a handful of past recessions.

Recessions Overview

We can define a recession as a period of economic slowdown that includes two periods of economic contraction.

They typically last 8 to 18 months and are usually accompanied by bear markets, rising unemployment, and loosing of fiscal policy (after a period of aggressive tightening).

Historical Recessions

There have been a total of 19 recessions in America's financial history. Let's take a look at some of the most recent ones:

- December 1969 to November 1970: During this moderate recession under Nixon's presidency, the Fed increased interest rates to counter a long period of expansion. The Fed then lowered rates in response to unemployment, which peaked at 5.5%

- November 1973 to March 1975: This recession that spanned the Nixon to Ford presidency was triggered by an oil crisis and brought an end to the post-World War II economic expansion. It was characterized by stagflation, in which high inflation accompanied unemployment as high as 8.8%— forcing the Fed to lower interest rates.

- January 1980 to July 1980: This recession under the Carter administration was triggered by an energy crisis resulting from an Iranian revolution. High oil prices caused sharp inflation as high as 13.5%. It culminated with unemployment of 7.5%.

- July 1981 to November 1982: Occurring during the Reagan presidency, unemployment as high as 11% during this recession was a continuation of the previous one. The Fed's actions were spearheaded by chairman Paul Volker who initially tried to combat inflation by targeting money supply rather than interest rates. When this method proved insufficient, the Fed raised interest rates as high as 21.5%.

- July 1990 to March 1991: Caused by the Iraq invasion of Kuwait and subsequent spike in oil prices and inflation, this recession saw unemployment rise to 6.8%.

- March 2001 to November 2001: This memorable recession was triggered by a burst of the euphoric dot-com bubble and the 9/11 attacks during which time unemployment rose to 5.5%.

- December 2007 to June 2009: Known as the Great Recession, this recession was triggered by the collapse of the housing bubble and saw unemployment rates rise to 10%.

- February 2020 to April 2020 period: The covid recession, which is still fresh in everyone's mind, was accompanied by widespread shutdowns and temporarily ultra-high unemployment.

Takeaways

The recessions throughout America's history all look very different. Although there are some common themes.

The main theme has been expansion in monetary policy in the years preceding the recession. This was often the result of efforts to fund a war or stimulate the economy after a previous recession.

Another theme is that stocks of companies that make necessities like consumer staples and food tend to perform better. Discount stores especially tend to perform well. And healthcare, another essential sector, also tends to outperform.

And finally, it can be helpful to keep in mind that since World War II, recessions have averaged 11 months.