Divided on Earnings Estimates

Good morning,

The markets are showing minor signs of recovery as interest fears have temporarily subsided. However, although the S&P 500 closed last week with a positive 6.4% gain, it is still down 18% from its record high set at the very onset of January. That means that that the index is starting this week with its head just barely above water, given that a bear market is defined as a 20% drop from previous highs. The bottom line: investors nevertheless have some tough water to tread this week, since Jerome Powell and has no intention of backing down from his battle with inflation. "We can’t fail on this. We really have to get inflation down," he said.

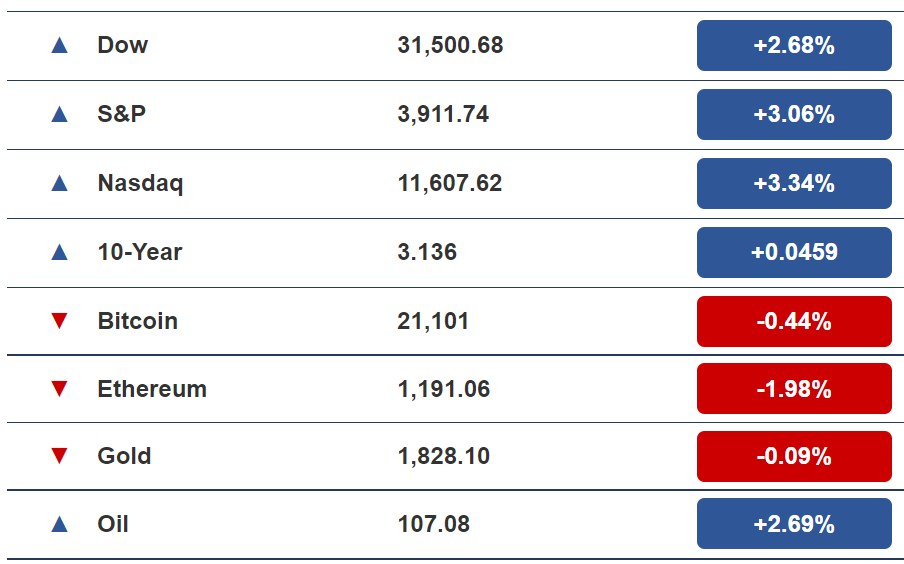

MARKET SNAPSHOT

*Stock prices as of yesterday’s market close. Crypto prices as of yesterday at 6 PM ET.

Anyway, here's what other wealth and health news is on our radar today:

- The reason to start waking up earlier this week

- What lower earnings estimates could mean for stocks

HEALTH

The Benefits of Waking up Early + Tips to Do It

What's the simplest way to boost both your health and your productivity?

Wake up earlier!

The benefits of getting an early start to your day and week greatly outweigh the comforts of remaining between a warm set of bedsheets.

The Benefits

- More energy: Creating a routine of going to bed early and waking up early leads to a better sleeping pattern that allows you to tackle your day much more effectively.

- More productivity: The brain tends to be more alert in the morning, which means you can complete tasks faster. There will also be less distractions from other people in the early morning, so you can accomplish more.

- More exercise: One of the main excuses not to exercise is not having enough time. But waking up early means you can easily find time to go for a run or hit the gym.

How to Wake up Early

- Go to bed earlier: One of the biggest obstacles to waking up early is thinking you did not receive enough sleep. If you get to bed by 10, you can still wake up at 6 having received the recommended 8 hours of sleep.

- Start slowly: Try waking up 15-30 minutes earlier than usual and then gradually waking up earlier every few days over the next two weeks.

- Move your alarm: Putting your alarm outside your reach in a different area of your bedroom will force you to get out of bed.

- Avoid snacking before sleep: Eating food late at night can cause you to feel tired when waking up in the morning.

MARKETS

Wall Street Is Divided on Earnings Estimates

Wall Street investors and analysts are digging their heels into the ground and tugging a rope across a line that divides two opposing views.

The subject in question: earnings estimates.

While many on the Street are insisting that earnings estimates are currently too high, others argue that current estimates will effectively forecast the quarters ahead.

Why Earnings Estimates Matter

Investors watch earnings forecasts carefully for clues on the appropriate valuations of stocks.

If companies and analysts drop earnings forecasts, investors are likely to follow suite by selling stocks.

This means that if estimates are revised and lowered, much more pain could lie ahead for the stock markets.

Where Estimates Are Now

Over the past month, analysts have actually increased their 2022 estimates.

They have forecast that the S&P 500 could increase profitability to 10.6% from the 10% estimates a month ago and 8.7% estimates at the beginning of the year, according to data from Bloomberg Intelligence.

The "Too High" Side

Those in favor of lowering estimates think that the Fed will continue to hike interest rate hikes— as it has already made clear— in an effort to bring down stubbornly high inflation.

They believe that Fed action will lead to an economic slowdown on the horizon, which will chip away at company profits.

A recession is becoming an increasingly likely scenario and most of the recent earnings estimates were based on based on better times earlier this year when Fed action was less aggressive.

For that reason, they think estimates are overly optimistic and need to come way down.

The "Just Right" Side

Some of those in favor of keeping estimates the same cite one indicator, known as estimate dispersion, as part of their argument.

Estimate dispersion measures how much the highest and lowest analyst per-share predictions vary on the average stock.

It currently reveals that the spread has stayed stable, even though the S&P 500 has descended into a bear market, according Credit Suisse data.

This means that even though market conditions have appeared increasingly unstable, analysts have increased their conviction that current estimates should remain the same.

What to Avoid

Despite sound reasoning by analysts unwilling to budge, Wall Street is likely to scale back its forecasts for corporate earnings.

That could be devastating for stocks, so it is more important than ever that investors take the appropriate precautions to protect their portfolios and invest only in stocks most likely to weather the storm.

One category of stocks that we can consider steering clear of is consumer discretionary. This is a category of stocks characterized by goods and services that are considered non-essential by consumers.

Although these goods and services are desirable when income is available to purchase them, they will likely take a beating during a recession and suffer from tough analyst revisions.

Some examples of consumer discretionary products and services include durable goods, high-end apparel, entertainment, leisure activities, and automobiles.