Sectors with Best Earnings Estimates

Good morning,

Some investors feel that now is a good time to start buying back into the market. Doing so requires careful sectoral analysis, since certain sectors could provide better entry points than others. But the case for a continued market decline is still strong. Federal Reserve Vice Chair Lael Brainard indicated that she doesn't expect the central bank to pause its aggressive rate hiking. She thinks that reaching to a 2% inflation target will still require quite a bit of work.

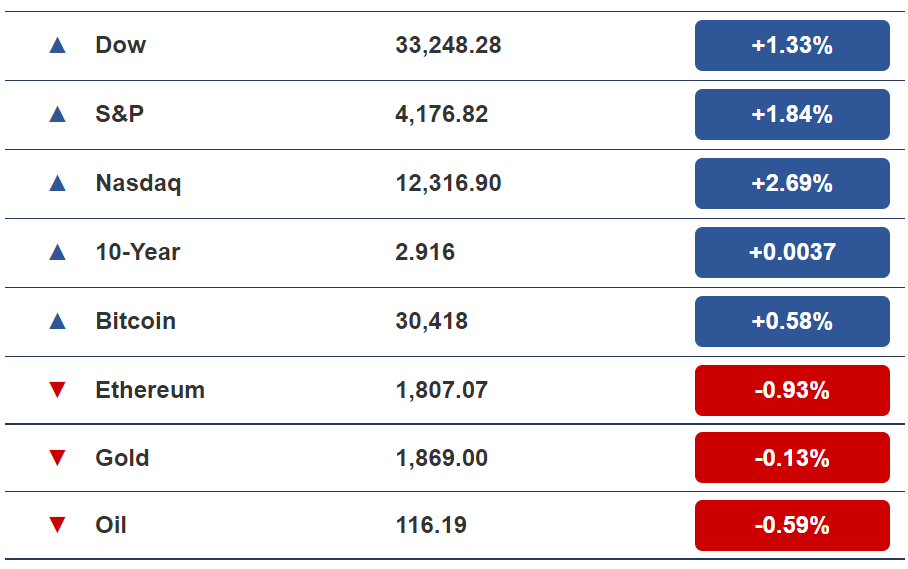

MARKET SNAPSHOT

*Stock prices as of yesterday’s market close. Crypto prices as of yesterday at 6 PM ET.

Anyway, here's what other wealth and health news is on our radar today:

- Solutions to low T levels

- Sectors with best earnings estimates

HEALTH

Foods that Boost Testosterone

Low T levels?

The issue becomes increasingly relevant to men as they age, considering that 40% of men over 45 years old and 50% of men in their 80s suffer from the issue, according to research.

It can also be onset by high body fat, diets with highly-processed foods, health conditions, and certain medications.

The issue occurs whenever testosterone levels drop below 300 nanograms/deciliter (ng/dL).

Although the issue can be treated through testosterone replacement therapy, a healthy lifestyle paired with exercise and a handful of the following testosterone boosting foods can alleviate the issue:

Fatty fish: Not only are fish like salmon and sardines high in protein, they benefit the hormones by boasting a number of nutrients, including omega-3 fatty acids, vitamin D, and zinc.

Eggs: The yokes of eggs contain a powerful combination of proteins and fats. They also contain the mineral selenium, which has been shown to increase testosterone production by activating pathways for some genes.

Avocados: Another source of healthy fat, these green fruits contain magnesium and boron, which could boost T levels in certain people.

Leafy greens: Spinach, kale, and collard greens also contain lots of magnesium, which support testosterone by decreasing oxidative stress.

MARKETS

Earnings Estimates Provide Clues on Which S&P 500 Sectors Could Outperform

Weak company sales and earnings guidance for the current quarter has sent shockwaves through the market.

An economic slowdown on the horizon means that investors are positioning themselves for another downturn.

Many of them have already been scrambling for cover in the commodities market, which provides much greater security.

Just how low could the market go?

One way to estimate that is to look at the forward price-to-earnings ratio of the S&P 500 and its individual sectors.

The forward price-to-earnings ratio of the S&P 500 through May 31, 2022 is down to 17.5 from its peak of 21.5 when things were looking frothy on December 31, 2021. Given that the ratio has averaged 15.7 over the past 20 years, we shouldn't be surprised if the market moves lower, especially as the Fed continues to ratchet down.

Sectors with Best Earnings

One potentially effective strategy that could provide adequate diversification and limited downside risk is buy or rebalance into ETFs based on sectors with the best forward price-to-earnings.

First lets consider the forward earnings estimates leading up until the present year period.

Although the energy sector has already has a stellar year, its May 31, 2021 forward price-to-earnings ratio of 10.9 looks the best of all the sectors. Beyond that, financials and materials look the strongest with forward price-to-earns of 12.6 and 14.6 respectively for that same period.

Now let's consider estimates for 2023 and 2024. While forward price to earnings may not be as reliable as current or historical price-to-earnings data, its use of forecasted earnings can provide helpful clues on what to expect.

Looking ahead: The earnings estimates of companies within certain sectors are poised to hold up much better than others over the coming months and next couple of years. The sectors expected to show double digit increases in earnings in 2023 and 2024 are the industrial, financial, communication services, and consumer discretionary sectors.