New Portfolio Allocation Playbook

Good morning,

Is the market rally real? Last week, the S&P 500 and Dow rebounded after nearing the the 20% drop from previous highs, which defines a bear market. They gained 5.5% and 4% respectively. Meanwhile, the Nasdaq charged 7.7%. Let's see if it can hold! Good earnings results and economic data are a contributor to the latest improved sentiment. Data shows that U.S. spending is increasing for the fourth straight month, but the best recent earning reveal Americans are gravitating to discount stores in order to do so. Dollar Tree, Ultra Beauty, and Ross stores were of few of the best stock performers last week, putting up 20% gains or more.

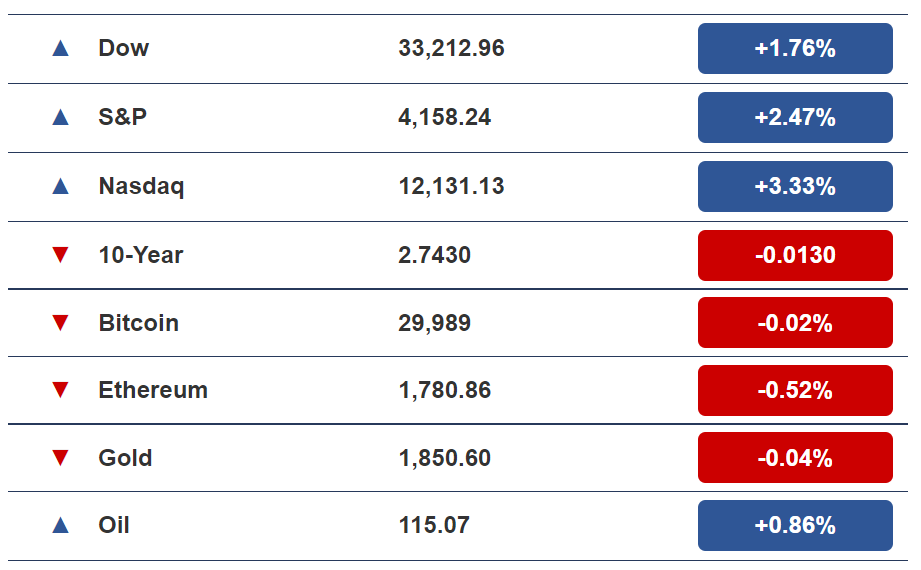

MARKET SNAPSHOT

*Stock prices as of yesterday’s market close. Crypto prices as of yesterday at 6 PM ET.

Anyway, here's what other wealth and health news is on our radar today:

- The secret to reading food labels

- Critical portfolio reallocation strategies

HEALTH

How to Read Labels on Grocery Items

Here's a scenario: You're standing in the aisle in the grocery store looking at a box of pre-made food.

How do you know whether the food inside that box is actually good for you?

The key is to learn how to read the labels.

These convenient types of foods aren’t necessarily unhealthy, but they often contain many added and undesirable ingredients.

What to Look for

Refined grains, artificial sweeteners, and highly processed oils are just a few of the things that we want to look out for.

Many of the extra ingredients added to our prepared foods and snacks are GMOs that we definitely want to avoid.

GMO Ingredients: Amino acids, aspartame, ascorbic acid, sodium ascorbate, vitamin c, citric acid, sodium ascorbate, ethanol, flavorings (“natural” and “artificial”), high-fructose corn syrup, hydrolyzed vegetable protein, lactic acid, maltodextrin, molasses, monosodium glutamate (MSG), sucrose, textured vegetable protein (TVP), Xanthan Gum

Rule for thumb: If you’re ever in doubt over whether an ingredient is healthy, just ask yourself whether you can pronounce it. If you can’t pronounce it, chances are it's not good for you.

MARKETS

Investors Must Re-Think Traditional Portfolio Allocation During Inflation

Portfolio diversification is now more important than ever, as inflation and rising interest rates are exposing the vulnerabilities of many companies previously perceived as highly attractive.

That's why the first rule of diversification is: Never put all your eggs in one basket.

Many inexperienced investors are now confronting the reality of this all-important investing rule as the market selloff continues to inflict pain on individual positions.

- Coinbase (COIN) has shed 70% of its value year-to-date as the crypto markets undergo turmoil.

- Netflix (NFLX) and Zoom (ZM), the pandemic superstars, are down 67% and 40% during that time.

- Meta (FB) has lost 42% of its value as the current risk-off environment cast a shadow over heavy spending and speculation in the metaverse.

Better Diversification

Even some of the most time-tested advise on portfolio diversification hasn't been enough to offset the damage to investors right now.

The conventional 60/40 portfolio allocation recommendation between stocks and bonds is now out the door, as bonds fall in tandem with stocks this year.

The 60/40 allocation outperformed cash by 10.5% over a 10-year period as a whole ending on September 2021, according to Mercer Wealth Management.

While the 60/40 allocation was perfect for the 2010s, some adjustments to that allocation may allow it to perform better in the current high inflation environment.

Those adjustments could include adding more real estate investment trusts (REITs) to the 60% stock mix. It could also include adding floating rate assets, which yield more as interest rates rise, to the 40% bond mix.

Adding Private Assets

Investment advisory firm KKR recently released a new recommendation that investors change their portfolio allocation to a 40/30/30 mix of stocks, bonds, and private assets.

Private assets are assets that are held in investments that are not publicly traded.

That could include various forms of private equity, such as privately managed equity real estate funds. It could include direct investment into private operating businesses through improving, restructuring, and acquiring. And it could include personal investments (homes, land, planes, boats, artwork, etc.).

Other factors: The exact asset allocation strategy that an investor chooses will not just depend on the current market circumstances. It will also depend on an investor's age, goals, and risk tolerance.